While watching my children run around the backyard this past weekend, my mind began to wander. I found myself reflecting on this crazy year. The funny thing is I also found myself thinking about how a fable illustrates one of the greatest values of modern portfolio theory. The events over the last 80+ days exemplify one of the benefits of diversification. Diversification facilitates a more consistent rate of return (i.e. a lower variance in returns). Aesop’s fable of the “Tortoise and the Hare” illustrates how consistently moving forward is better than the variable progress of the faster hare. These two concepts (diversification and lower variability) also help explain why I started Autumn Lane Partners.

Here are just a few news headlines from this year so far:

- Jan 2, 2016 – “Saudi Execution of Shia Cleric Sparks Outrage in Middle East” (The Guardian)

- Feb 8, 2016 – “U.S. Stocks Drop Again, and S&P 500 Falls Below August Lows” (Wall Street Journal)

- Mar 1, 2016 – “Get Ready to Say President Trump” (U.S. News & World Report)

- Mar 18, 2016 – “S&P 500 Turns Positive for 2016 as Recession Fears Fade” (Reuters)

- Mar 24, 2016 – “Brussels Attacks Add Urgency to Debate Over Britain’s E.U. Membership” (New York Times)

I doubt many of us knew these things would occur beforehand, just as I doubt any of us can predict whether or not Great Britain will leave the E.U. The unknown scares most people, so we often look for sage advice. When it comes to investing, many turn to Cramer or the other investment gurus of Wall Street. From my perspective, Cosmo Kramer would provide just as valuable of advice. I do not intend to demean market forecasters, but am simply pointing out that too many factors are at play to accurately and repeatedly predict the future of the overall market.

So, how should we invest in a world where the markets can fall 10% in the first 42 days only to then rally over 11% the next 42 days? The answer is simple and often repeated; we should build a diversified portfolio. The two reasons for this are:

- As demonstrated in the first quarter of 2016, we do not know what is going to happen tomorrow; and

- There is a cost to the variance of returns (said another way, there is a benefit to “slow and steady”).

It is the second point that Aesop’s fable does such a great job of illustrating. The concept we are discussing is “compound returns.” The power of compound returns is that we earn money on the profits of previous time periods. However, returns only compound if we made money in the previous period. If we did not make money or if we lost money in the previous period, there are no profits to compound. Thus, if returns vary from period to period, there is a cost associated with the possibility of failing to compound the previous period.

Aesop’s fable chronicles the great race between the tortoise and the hare. Although the hare is much faster than the tortoise, he loses the race because of his propensity to stop and nap. Whereas, the tortoise just keeps putting one foot in front of the other. Thus, slow and steady (modern portfolio theory) beats fast and variable!

Let’s look at an example to show how this concept specifically applies to investing. In this scenario we have two investment options:

Portfolio 1 – a portfolio of a single investment:

Investment A returns 20% and 0%, alternating every other year.

Portfolio 2 – a 50/50 portfolio of two investments:

Investment A returns 20% and 0%, alternating every other year; and Investment B returns 19% and 0%, alternating every other year, and it earns 19% when Investment A earns 0%.

The results of investing $1,000,000 in each of these portfolios are:

| Portfolio A | Cumulative Portfolio Value | Asset A | Asset B | Portfolio B | Cumulative Portfolio Value | ||

| Year 1 | 20.00% | $1,200,000 | 20.00% | 0.00% | 10.00% | $1,100,000 | |

| Year 2 | 0.00% | $1,200,000 | 0.00% | 19.00% | 9.50% | $1,204,500 | |

| Year 3 | 20.00% | $1,440,000 | 20.00% | 0.00% | 10.00% | $1,324,950 | |

| Year 4 | 0.00% | $1,440,000 | 0.00% | 19.00% | 9.50% | $1,450,820 | |

| Year 5 | 20.00% | $1,728,000 | 20.00% | 0.00% | 10.00% | $1,595,902 | |

| Year 6 | 0.00% | $1,728,000 | 0.00% | 19.00% | 9.50% | $1,747,513 | |

| Year 7 | 20.00% | $2,073,600 | 20.00% | 0.00% | 10.00% | $1,922,264 | |

| Year 8 | 0.00% | $2,073,600 | 0.00% | 19.00% | 9.50% | $2,104,879 | |

| Year 9 | 20.00% | $2,488,320 | 20.00% | 0.00% | 10.00% | $2,315,367 | |

| Year 10 | 0.00% | $2,488,320 | 0.00% | 19.00% | 9.50% | $2,535,327 | |

| Year 11 | 20.00% | $2,985,984 | 20.00% | 0.00% | 10.00% | $2,788,860 | |

| Year 12 | 0.00% | $2,985,984 | 0.00% | 19.00% | 9.50% | $3,053,802 | |

| Year 13 | 20.00% | $3,583,181 | 20.00% | 0.00% | 10.00% | $3,359,182 | |

| Year 14 | 0.00% | $3,583,181 | 0.00% | 19.00% | 9.50% | $3,678,304 | |

| Year 15 | 20.00% | $4,299,817 | 20.00% | 0.00% | 10.00% | $4,046,135 | |

| Year 16 | 0.00% | $4,299,817 | 0.00% | 19.00% | 9.50% | $4,430,517 | |

| Year 17 | 20.00% | $5,159,780 | 20.00% | 0.00% | 10.00% | $4,873,569 | |

| Year 18 | 0.00% | $5,159,780 | 0.00% | 19.00% | 9.50% | $5,336,558 | |

| Year 19 | 20.00% | $6,191,736 | 20.00% | 0.00% | 10.00% | $5,870,214 | |

| Year 20 | 0.00% | $6,191,736 | 0.00% | 19.00% | 9.50% | $6,427,884 | |

| Average Annual Return | 10.00% | 9.80% | |||||

| Standard Deviation | 10.00% | 0% | |||||

| Compounded Rate of Return | 9.50% | 9.70% | |||||

| Future Value at Year 20 | $6,191,736 | $6,427,884 |

The interesting thing about this simplified example is that although Portfolio 1 has a higher average return, it earns $236,148 less than Portfolio 2 over the 20 year period. This may seem counterintuitive. However, it is just like the hare losing to the tortoise. Portfolio 1 can clearly run faster, but its variability has a cost. The cost of variability is the periodic lack of compounding. Portfolio 1 only compounds its profits every other year. Whereas, Portfolio 2 compounds every year. Slow and steady, while it may appear mundane, wins the investing race too!

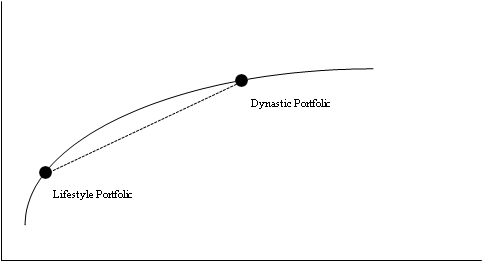

The goal of modern portfolio theory is to maximize the expected rate of return for a given level of risk. Risk is measured by the variance in returns from what we expect (commonly we use standard deviation for this measure). We showed in our example above that if we have two negatively correlated investments (i.e. whose returns move in the opposite directions), we can lower the volatility of the whole portfolio. By maximizing the return/risk dynamic, we decrease our portfolio’s return variance, and we increase our compounded return.

This is one of the key reasons that led me to start Autumn Lane Partners. Throughout my career I have built and managed many investment portfolios, and I noticed my larger portfolios typically outperformed the smaller portfolios on a risk- adjusted basis. I believe the explanation for this is two-fold:

- Larger portfolios can negotiate lower fees; and

- Larger portfolios have a wider selection of investment choices.

The first point’s effect is obvious. The second point deserves more discussion. One rarely builds a two asset portfolio like the one I used in my example. Instead, we build portfolios with multiple investments. Our goal is to find investments that are uncorrelated (i.e. whose returns are not dependent upon one another). By combining these uncorrelated investments, the resulting “diversified portfolio” has a much lower variance. The key though is that each investment needs to be independent from the other (at least as much as possible).

The issue with smaller portfolios is that they have fewer investments from which to choose. Many potential investments are not available due to minimum investment requirements. For example, most of the hedge funds in which Autumn Lane Partners invests have a $5 million minimum investment threshold. Thus, to recreate the Autumn Lane Partners portfolio literally requires $100 million.

Wall Street’s solution to this problem is to settle. Rather than trying to build the optimal portfolio, Wall Street “customizes” the client’s portfolio to each investor’s limitations. In other words, after excluding all the investments one cannot invest in, Wall Street provides the optimal solution with what’s left…

I never liked this answer, and the sub-optimal solutions definitely played a role in explaining why our larger portfolios outperformed the smaller portfolios. It also explains why many wealthy families create investment partnerships to combine assets across entities and generations. The combined assets in these family investment partnerships can access more investments, as well as negotiate better fees. This is exactly what we built with Autumn Lane Partners. With a $100 million seed investor, we were able to strive for the optimal portfolio and use modern portfolio theory. And with our partnership structure, smaller portfolios can now get their pro rata share of this solution. The result is better diversification, a more consistent rate of return, and the resulting compounding effect. Slow and steady wins again.

Disclosures:

This information is provided, on a confidential basis, for informational purposes only and does not constitute an offer or solicitation to buy or sell any security. It is intended solely for the named recipient, who, by accepting it, agrees to keep this information confidential. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents. There can be no guarantee that a client will achieve the intended investment returns or objectives. There are associated risks with all investments and those risks are described in the investment advisory agreement. The information contained in this material does not purport to be complete, is only current as of the date indicated, and may be superseded by subsequent market events or for other reasons. Past performance is no guarantee of future results. Autumn Lane Advisors, LLC is not a law firm, CPA firm or insurance agency and does not provide legal advice, tax advice or insurance products.

© 2020 Autumn Lane Advisors, LLC. All rights reserved. This material may not be reproduced, displayed, modified or distributed without the express prior written permission of the copyright holder. Send email requests to info@autumnlanellc.com.