The 2008 drawdown in the valuation of all risk-bearing assets highlighted a significant problem with the use of Markowitz’s efficient frontier to “optimize” a private client’s portfolio. The issue is that a private client’s risk tolerance is not constant. Not only does it adjust throughout life as cash flow needs and life expectancy change, private clients also tend to increase or decrease their risk tolerances when market conditions change. Unfortunately, this latter adjustment tends to happen in the wrong direction at the wrong time. If only people could follow Warren Buffett’s suggestion to “be fearful when others are greedy and greedy when others are fearful.” Let’s dive in further to the two goal allocation.

This paper’s goal is to combine behavioral finance and modern portfolio theory to improve a private client’s investment returns over a full investment cycle. The idea is to use a common behavioral bias, mental accounting, to enable the maintenance of a constant risk profile. Simply put, private clients should manage separate portfolios to meet two independent goals: 1) lifestyle spending needs and 2) long- term or dynastic wealth creation. With two constant risk profiles, the portfolios are easier to maintain, resulting in superior returns and higher utility to the private client investor.

Introduction

In the game of marbles, the shooter marble is also referred to as the “TAW.” During a discussion with one of my clients, he mentioned he was creating a new partnership called “TAW.” He went on to lay out a conservative investment policy for this partnership. He explained the peculiar name by quoting a piece of advice from his father, “never lose your ‘TAW’ when playing marbles, that way you can always play another game.” So, this new partnership was my client’s investment “TAW,” and I was told to never lose it because he wanted to keep playing.

The TAW partnership provided a specific benefit. It allowed us, his financial advisors, to design a long-term and growth-oriented portfolio for the surplus assets. These surplus assets were not managed for our client per se, but for his children, grandchildren, and the family foundation. He had effectively subdivided his assets into a lower risk portfolio and a long-term growth portfolio.

The above story helped clarify an idea that had been bouncing around in my head; an idea that would facilitate a positive investment outcome via a common behavioral bias – mental accounting. A clear example of mental accounting is that of a person who walks into a casino and says “as long as I leave with the cash in my left pocket, I am ok.” He then goes on to gamble with the cash from his right pocket. What is the difference between the cash in the two pockets? Nothing is different except for the way the gambler feels.

This bias becomes more evident with winnings. When a person wins in a casino, he will often gamble more aggressively with his winnings, which he refers to as “the house’s money.” However, it is not the “house’s money;” it is his money. He could safely walk out of the casino without security tackling him. So why is he more comfortable to lose his winnings? All this person has done is mentally separated the money into buckets.

The drawdown in the valuation of all risk-bearing assets during the winter of 2008/2009 highlighted a significant problem with the use of Markowitz’s efficient frontier to “optimize” a private client’s overall portfolio. The issue is that a private client’s risk tolerance is not constant. Not only does it adjust throughout life as cash flow needs and life expectancy change, private clients also tend to increase or decrease their risk tolerances when market conditions change. The dynamic nature of a private client’s risk tolerance in relation to market conditions can be linked to the bias of mental accounting.

When markets are good and investors are making money, they say “let it ride!” In their minds, they are only playing with the gains of the past… Unfortunately, this increase in risk tolerance tends to happen at the wrong time, just as many assets are becoming overvalued. If only people could follow Warren Buffett’s suggestion to “be fearful when others are greedy and greedy when others are fearful.”

Through the combination of behavioral finance and modern portfolio theory, we can improve a private client’s investment returns over an investment cycle. The crux of the idea is to use the common bias of mental accounting to facilitate the maintenance of a constant risk profile. With a constant risk profile, the private client’s portfolio is easier to maintain and would ultimately deliver better returns and a more satisfying investment experience.

Behavioral Bias – The Good, the Bad, and the Ugly

Richard Thaler use to write a column in the Journal of Economic Perspective entitled “Anomalies” in which he began each article with the following statement:

Economics can be distinguished from other social sciences by the belief that most (all?) behavior can be explained by assuming that agents have stable, well-defined preferences and make rational choices consistent with those preferences in markets that (eventually) clear. An empirical result qualifies as an anomaly if it is difficult to “rationalize,” or if implausible assumptions are necessary to explain it within the paradigm…

In the most recent market downturn, we are all reminded of the fact that private client investors suffer from loss aversion; private client investors are more sensitive to losses than they are to gains of equal magnitude. I have heard economists say this is irrational and suggest that private clients should be able to stare down losses and rebalance their portfolios when asset classes underperform. However, for those private clients who will likely use this wealth for future consumption, the risk of

additional losses is likely more important than equal future gains. Such losses could affect their lifestyle. In my mind, loss aversion is not irrational but rather a rational fear based on the well-defined preference to maintain a specific lifestyle.

Thus, in this world of loss aversion, how can financial advisors convince private clients to hold the line? How can we convince them that the efficient portfolio created by mean-variance optimization will deliver the best results over an investment cycle? This is an extremely difficult argument for any financial advisor to convincingly make. For instance, what if the investment cycle’s duration is longer than the period in which a private client can hold their risk tolerance constant. Financial advisors are taught to use time horizon as a factor in determining a client’s ability to take risk. However, this time horizon shrinks with age (assuming the assets are used by the client and not left for future generations or charity).

This leads us to the question of how long is the investment cycle? Although this paper does not cover this topic in detail, I should point out there is much debate as to the actual length of an investment cycle. Many people point to data from the National Bureau of Economic Research showing there have been 10 cycles from 1945-2001, with an average duration of 67 months between peaks. However, an investment cycle may span multiple economic expansions and contractions. If we cannot define exactly how long an investment cycle is, how can a financial advisor possibly recommend a single efficient portfolio to meet his/her client’s future goals?

The answer is that most private clients should not utilize a single portfolio. Instead, they should create a lower risk portfolio (“TAW” or “Lifestyle” portfolio) and a higher risk portfolio for the remaining assets (“Legacy” or “Dynastic” portfolio).

The Lifestyle Portfolio

One benefit of dividing the goals of the private client into two distinct buckets is the simplification of risk profile discovery. Private clients may not know how much “volatility” they can stand, but they will likely know how much money they spend now and wish to spend in the future. Thus, with an assumption for expected inflation, we can quickly identify the amount needed to meet this goal. If there is a “capital preservation” goal in addition to the cash flow goal, we can account for this by adding a terminal value greater than zero. Either way, a simple annuity formula is used to calculate the present value of the necessary portfolio:

PV = (C / i) x (1 / (1+i)n) + FV/(1+i)n

Where “PV” is the present value of the required capital, “C” is the annual cash flow requirement, “i” is expected inflation, “n” is the number of periods, and “FV” is the capital preserved until time n.

Now that we have the size, we can focus on the asset allocation and implementation of the Lifestyle portfolio. This portfolio will obviously lie on the left side of the efficient frontier (i.e. conservative side). Its main purpose is to:

- Meet the real income needs of the client; and

- Preserve capital.

The three main risks with which this portfolio is concerned are market risk, credit risk, and purchasing power risk due to inflation. Since the lifestyle portfolio will produce income, taxes will also affect the allocation of the portfolio. Thus, I will make three general recommendations for taxable investors:

- The majority of the portfolio should consist of high-quality fixed income securities;

- The fixed income portfolio should have a short to intermediate duration (2.0-4.0 years); and

- Some allocation to US equities, real estate investments trusts, and other risky assets may be suitable to hedge against unexpected inflation and to produce income.

Optimal versus Suboptimal Allocation

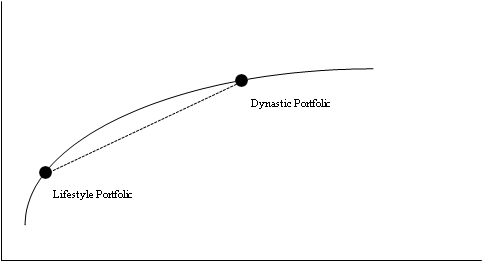

The most obvious argument against the creation of two distinct portfolios is that the average of the two portfolios would lie below the efficient frontier. This is easily illustrated with a graph. Figure 1 shows that a combined portfolio of a low-risk lifestyle portfolio with a more aggressive dynastic portfolio would fall somewhere along a linear line connecting the two portfolios, thus creating a suboptimal total portfolio.

Figure 1.

The simplest defense against the claims of inefficiency is whether or not the comparison frontier is actually efficient itself. There are many assumptions that could adjust the location of the curve, most notably return and covariance.

We could also set about trying to appease the MPT disciples by creating two portfolios as described above, identifying the volatility of the aggregate portfolio, reallocating to the efficient frontier assuming that specific volatility, and then splitting the portfolio into two separate buckets again. In other words, we back into the average risk profile of the client and then split the allocation back up again into a conservative and more aggressive bucket. The problem with this idea is determining which assets move to the Lifestyle Portfolio versus the Dynastic Portfolio. If we set the aggregate portfolio on the efficient frontier, the Lifestyle and Dynastic portfolios are now off the curve and cannot be easily modeled utilizing a mean variance optimizer. Thus, this strategy creates more questions in order to solve a problem that may or may not truly exist.

A final argument for the two-portfolio allocation or two goal allocation goes back to the behavioral biases of private client investors. Assuming that the average portfolio created by the two- portfolio allocation is inefficient, would one rather have an inefficient portfolio that remained fully invested or an efficient one (at least originally efficient) that changed risk profiles mid-investment cycle due to fear or euphoria? It may just come down to selecting the best of two imperfect choices. For a more complete discussion of goal-based asset allocation and its relative efficiency, I would refer you to Jean L.P. Brunel’s paper entitled, “How Sub-optimal – If at All – Is Goal-Based Asset Allocation?” (Journal of Wealth Management, Fall 2006, Vol. 9, No. 2: pp. 19-34).

Conclusion

The Markowitz efficient frontier does provide the optimal portfolio for long-term assets. However, the optimal outcome requires investors to retain their portfolio’s risk level throughout an entire investment cycle. Since private client investors suffer from loss aversion and other behavioral influences, the theoretical outcome is rarely attained.

Using goal-based asset allocation, private client investors can take advantage of behavioral bias, mental accounting, to facilitate the maintenance of a constant risk profile throughout the investment cycle. Specifically, the two-portfolio or two goal allocation provides several other key benefits:

- A simpler way to define one’s risk profile;

- A lower level of anxiety during market drawdowns; and

- A more capital appreciation focus for the Dynastic portfolio.

Disclosures:

This information is provided, on a confidential basis, for informational purposes only and does not constitute an offer or solicitation to buy or sell any security. It is intended solely for the named recipient, who, by accepting it, agrees to keep this information confidential. An offer or solicitation of an investment in a private fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents. There can be no guarantee that a client will achieve the intended investment returns or objectives. There are associated risks with all investments and those risks are described in the investment advisory agreement. The information contained in this material does not purport to be complete, is only current as of the date indicated, and may be superseded by subsequent market events or for other reasons. Past performance is no guarantee of future results. Autumn Lane Advisors, LLC is not a law firm, CPA firm or insurance agency and does not provide legal advice, tax advice or insurance products.

© 2020 Autumn Lane Advisors, LLC. All rights reserved. This material may not be reproduced, displayed, modified or distributed without the express prior written permission of the copyright holder. Send email requests to info@autumnlanellc.com.