I am thrilled to introduce myself as the newly appointed Partner and Chief Investment Officer at Autumn Lane, effective last Friday. It has been a pleasure meeting many of you, and I eagerly anticipate connecting with everyone else. Before delving into a few market insights, allow me to share a bit about my background.

With 18 of the last 20 years dedicated to principal investment roles at Millennium Management, Carlson Capital, and most recently, Everpoint Asset Management (Point 72), my focus spans global public equities, bond portfolios, and private equity investments.

My connection with David Andrew dates to our time at Lehman in the early 2000s. I became an early client of Autumn Lane in 2017, and our enduring friendship has only strengthened over the years. I am excited about the opportunity to collaborate with David and the exceptional team he has assembled at Autumn Lane.

“One ring to rule them all” – J.R.R. Tolkien

In the second week of January, I had the privilege of attending a summit in Jackson Hole alongside impressive C-level executives from the Energy, Power, and Renewables sectors, as well as some of the largest global asset managers. It proved to be an enriching conference.

A key takeaway from other institutional investors was the macro impact on the market post-COVID era. I find myself closely following Fed meetings, a habit I didn’t have pre-COVID or even during the great financial crisis.

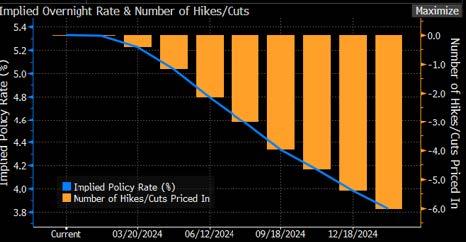

This week, the market’s attention is on the Richmond Fed Index (Tuesday), Purchasing Managers’ Index (PMIs) (Wednesday), Personal Consumption Expenditures and Durable Goods Orders, Initial Job Claims, New Home Sales (all Thursday), and Personal Consumption Deflator (Friday). While constructing portfolios throughout my career, I seldom focused on these high frequency data points, with the exception of PMI data as a leading indicator for commodity demand. The market eagerly awaits the next data point to gauge when the Fed might cut rates, with the current market pricing in six cuts by Q1 of 2025 (see below).

Why does this matter? The market seeks an anchor for the risk-free rate, in our case, the 10-year treasury bond. A lower 10-year rate historically correlates with a higher market valuation. As the risk-free rate contracts, justifying higher multiples becomes easier. However, the equity risk premium is currently the narrowest since 2002, emphasizing the need for accelerating earnings growth or higher market liquidity.

“Be careful what you wish for; you just might get it.” – Unknown

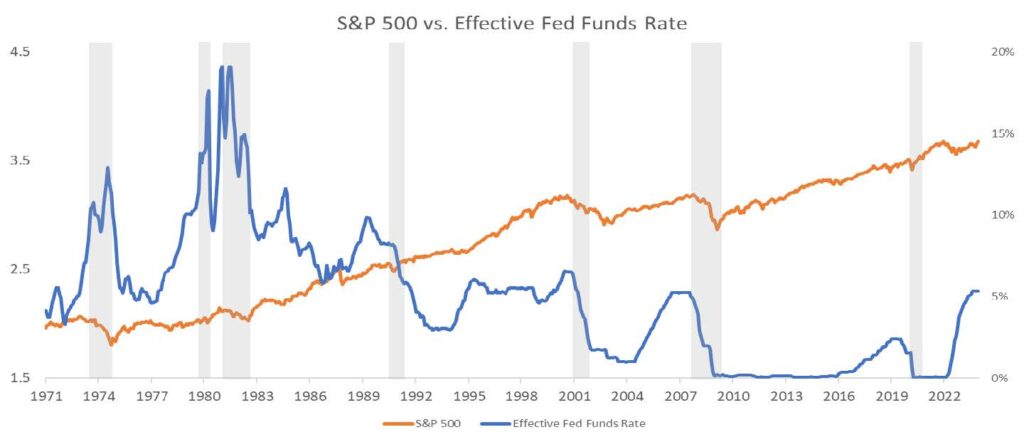

Empirically, equity performance (orange line) post the first rate cut has not been favorable. The market tends to peak into the first rate cut, forgetting that rate cuts (blue line) historically coincide with slowing economic growth and recession risk (grey bars).

“The future ain’t what it used to be.”- Yogi Berra

In my perspective, the majority of the fixed income pundits are fixated on a post-Global Financial Crisis (GFC) world, deeming anything surpassing a 3% 10-year as excessive. However, let’s not lose sight of the broader picture – over the past 60 years, the 10-year has averaged approximately 5.9%. When we strip away core inflation as measured by the Consumer Price Index (CPI excluding food and energy), this yields a 2.1% real rate over the last six decades.

Perusing the chart below underscores that post the GFC, real yields reached multi-decade lows. Nevertheless, it doesn’t strike me as unreasonable for the market to anticipate a 2.1% real yield, excluding the financial effects of Quantitative Easing. So, where does this position us on a nominal basis? Assuming a 2.5% inflation going forward, a 2.1% real yield, and some term premium (let’s say 100 bps), a back-of-the-envelope calculation brings us to 5.6% for the 10-year UST. While adjustments to these inputs are prudent and necessary, it appears evident that anything below 4% seems overly ambitious, unless investors are positioning defensively for a significant downturn (aka the hard landing).

“In investing, what is comfortable is rarely profitable. Taking all the data points in the market and formulating the right thesis requires stepping out of the comfort zone.” – Robert Arnott

Where does this leave us? Concerned about both equity and debt markets. The 10-year and major US indexes do not seem to offer good value in our opinion. Nevertheless, companies with high-quality businesses, strong barriers to entry, and excellent returns on invested capital are poised to continue to outperform. Where could we be wrong? If data indicates a potential plunge into a severe recession, bonds are likely to witness a rally (price up, yields down), following a playbook observed for generations. The abundance of risk-free assets, stemming from government deficit spending, may not hold immediate significance. On the equities front, the influence of animal spirits could persist, propelling valuations even higher.

As we review and make recommendations for our existing portfolios at Autumn Lane, we are identifying compelling niches in the global markets that appear promising, and I look forward to sharing more details in my next update.

Best Regards,

Jim Mooney

Partner and Chief Investment Officer

Autumn Lane

DISCLOSURES

This information is provided, on a confidential basis, for informational purposes only and does not constitute an offer or solicitation to buy or sell an interest in Autumn Lane Partners, LP (the “Fund”) or any other security. It is intended solely for the named recipient, who, by accepting it, agrees to keep this information confidential. An investment in the Fund is speculative and involves substantial risks. Additional information regarding the Fund including fees, expenses and risks of investment, is contained in the offering memorandum and related documents and should be carefully reviewed. An offer or solicitation of an investment in the Fund will only be made to accredited investors pursuant to a private placement memorandum and associated documents. Interests in the Fund can only be purchased by investors meeting all the requirements of the Fund. There can be no guarantee that the Fund will achieve its investment objectives. The information contained in this material does not purport to be complete, is only current as of the date indicated, and may be superseded by subsequent market events or for other reasons. In preparing this document, Autumn Lane Advisors, LLC has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources.

This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission. Send email requests to info@autumnlanellc.com.